net investment income tax brackets 2021

2021 Federal Income Tax Brackets. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Net investment income NII is income received from investment assets before taxes such as bonds stocks mutual funds loans and other investments less related.

. 2021 Long Term Capital Gains Tax Brackets. Discover Helpful Information and Resources on Taxes From AARP. 559 Net Investment Income Tax Internal Revenue Service.

You are charged 38 of the lesser of net investment. Short-term capital gains are taxed as ordinary income meaning the rates are the same as for the income you earn from your job. A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net.

A Time-Tested Flexible Approach For Todays Bond Market. Weve summarized income tax rates and details below for you for the tax year 2021 and filings in 2022. Tax bracket tax calculator calculates your Federal tax bracket based on your gross income and tax filing status.

In the case of an estate or trust the NIIT is 38 percent on the lesser of. To see what rate youll pay see What Are the Income Tax Brackets for 2021 vs. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

The adjusted gross income. Rate Married Joint Return Single Individual Head of Household. Unearned income Medicare contribution tax Net investment income tax 2021 2022.

2021 Federal Income Tax Brackets and Rates. In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1. This same couple realizes an additional 100000 capital gain for total AGI of 350000.

Ad Leverage PIMCOs Actively Managed Income Strategies. B the excess if any of. The net investment income tax an additional 38.

Ad See Whats Been Adjusted for Income Tax Brackets in 2022 vs. 2021-2022 Short-Term Capital Gains Tax Rates. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income.

Calculating NIIT is not just as simple as multiplying your net investment earnings by 38. Unlike the long-term capital gains tax rate there is no 0. Visit The Official Edward Jones Site.

The IRS gives you a pass. Many investors selling real estate or other high value investments are often surprised to find out that their tax liability could be subject to an extra 38 Surtax in addition to the applicable short. New Look At Your Financial Strategy.

Tax rate Single Married filing jointly Married filing separately Head of household. April 28 2021 The 38 Net Investment Income Tax. The investment income above the 250000 NIIT threshold is taxed at 38.

Become Expert in Investment - Investment Learning Quick Free Updated 2022. Those rates currently range from 10 to 37 depending on your taxable income. Qualifying widow er with a child 250000.

1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status. A the undistributed net investment income or. For the most part interest income is taxed as your ordinary income tax rate the same rate you pay on your wages or self-employment earnings.

Ad Learn Investment Easy - Investment Training 2022 - Free Investment Questions. 2021 Tax Brackets.

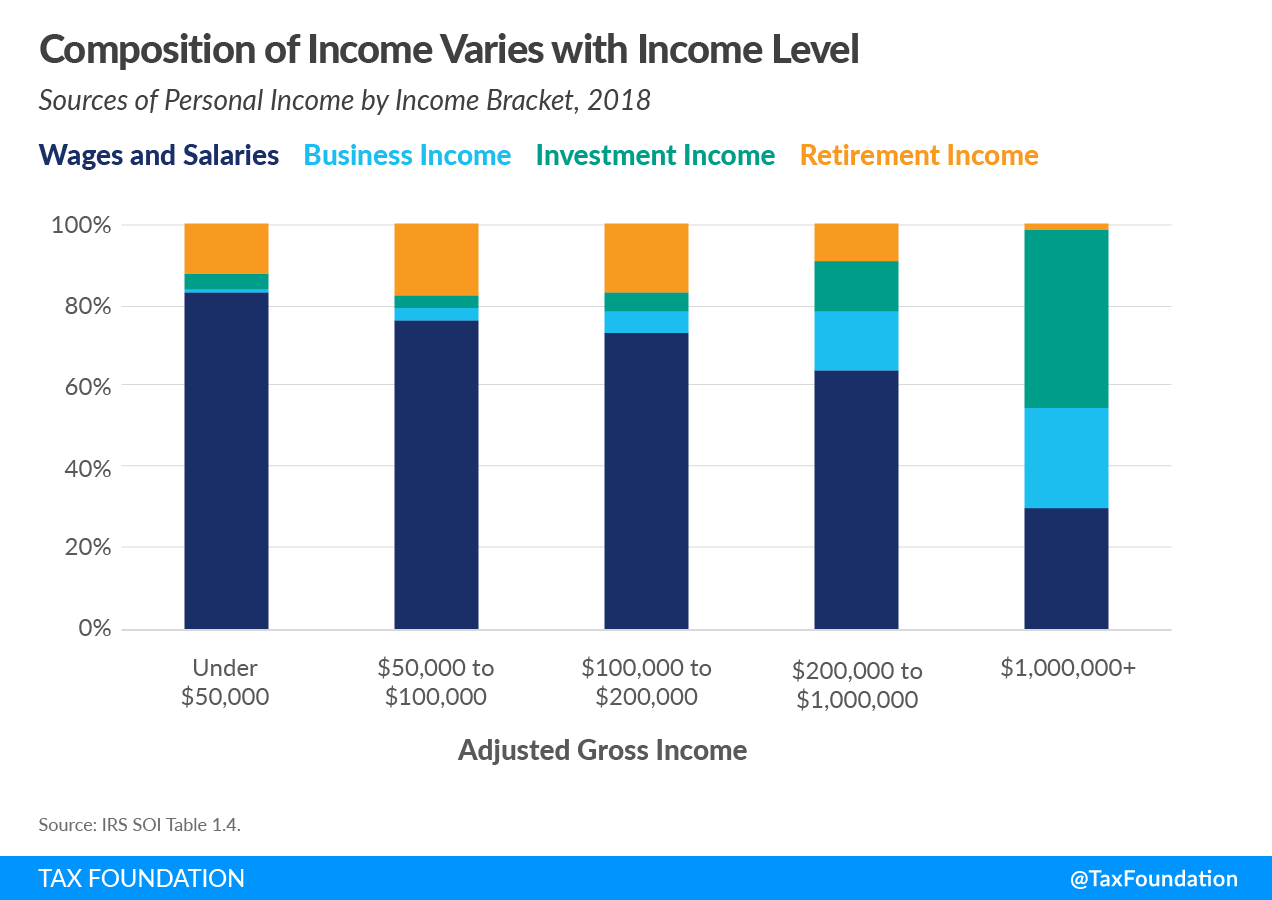

Sources Of Personal Income In The United States Tax Foundation

How To Calculate Your Profit In 2021 When Selling Your Rental Property Mortgage Blog Mortgage Blogs Rental Property Investment Buying Investment Property

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help Income Tax Income Tax

Editable Balance And Income Statement Income Statement Balance Etsy In 2022 Income Statement Balance Sheet Money Saving Strategies

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Net Investment Income Tax Schwab

Chart Do You Pay A Higher Tax Rate Than Mitt Romney What Is Credit Score Rich Kids Rich Kids Of Instagram

What Is The The Net Investment Income Tax Niit Forbes Advisor

How High Are Capital Gains Taxes In Your State Tax Foundation

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Self Employment Tax Rate Higher Income Investing Freelance Income

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

What Is The Net Investment Income Tax And Who Has To Pay It Bankrate

Raymond Skjaerstad Business Taxation Management Small Business Deductions Income Tax Return Insurance Deductible

Form 8615 Tax For Certain Children With Unearned Income Jackson Hewitt

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)